Rezolv Energy & Low Carbon hand Vestas EPC contract for VIFOR wind farm in Romania

Bucharest, 17 June 2024: Actis-backed Rezolv Energy and Low Carbon, through their project subsidiary First Looks Solutions S.R.L., have selected Vestas as the engineering, procurement and construction (EPC) partner for the first phase of the ‘VIFOR’ wind farm in Buzău County, Romania. Phase 1 will install 192MW in capacity, with planned expansion to 461MW in Phase 2.

The first phase of the VIFOR project will involve the installation of 30 EnVentus Vestas V162 wind turbines, each with a capacity of 6.4MW. The turbines have a tower height of 166 metres and a rotor diameter of 162 metres.

Once operational, VIFOR will be one of Europe’s largest onshore wind farms. Close to the Carpathian Mountains and benefiting from exceptional wind yields, the project will generate enough clean energy to power more than 270,000 homes and will avoid approximately 540,000 tonnes of CO2e annually. The project will support Romania in meeting its climate targets and play an important role in the region’s energy transition.

Last month, the Romanian Energy Regulatory Authority (ANRE) issued the setting-up authorisation for the first phase of the VIFOR project. This was the final approval required. Construction is scheduled to be completed within 18 months, with VIFOR coming onstream before the end of 2025.

Vestas’ role as EPC partner will involve working alongside Rezolv and Low Carbon to implement the Environmental and Social Management Plan for VIFOR. Rezolv’s sustainability strategy has been built on industry best practice and aligns with international standards, including the Equator Principles and the International Finance Corporation (IFC)’s Performance Standards on Environmental and Social Sustainability. One of its pillars is striving to ensure that each of its renewable energy plants supports flourishing and sustainable ecosystems.

In addition to the environmental benefits, VIFOR will create local jobs during both the construction and operational phases, deliver economic benefits, and support community initiatives in Buzău County aimed at ensuring that the project leaves a lasting, positive legacy for local people.

Last week, finance loan facilities of up to €291 million were secured to support the Phase 1 construction from a consortium of eight lenders led by Erste Group, UniCredit Group and the European Bank for Reconstruction and Development, as well as the International Finance Corporation (IFC), Intesa Sanpaolo Group, OTP Bank, Raiffeisen Bank International AG and Garanti BBVA Romania. Phase 1 is also underpinned by five landmark commercial power purchase agreements (PPAs).

Alastair Hammond, CEO, Rezolv Energy, said: “The VIFOR wind farm will play a significant role in reducing Romania’s dependence on fossil fuels, enhancing the country’s energy security and improving air quality. Vestas, as the world’s largest wind turbine manufacturer and with the greatest number of MWs installed in the region, is a natural partner for this, the first large wind farm in the CEE/SEE region in the past 10 years. Crucially, Vestas also shares our commitment to the responsible and sustainable development of renewable energy projects, which made them a natural choice for VIFOR.”

Martin Langham, Managing Director at Low Carbon said: “We are delighted to reach this major milestone in the development of the VIFOR wind project, which is a result of the tireless efforts of the team and our Rezolv partners over several years. The EPC agreement with the leading wind turbine manufacturer, Vestas, will be one of the largest contracts of its kind in Europe reinforcing our track record for delivering clean energy infrastructure on this scale. Furthermore, the project will play a key role helping Romania to decarbonise its electricity grid and accelerate the energy transition in Eastern Europe.”

Nils de Baar, President of Vestas Northern and Central Europe, said: “VIFOR will become one of the largest onshore wind projects in the region, contributing significantly to Romania’s energy transition ambitions. Vestas is pleased to deliver this order as a turnkey project, and our thanks go to our partners for the great collaboration and their trust in our industry leading technology.”

Rezolv Energy was launched 18 months ago by Actis, a leading global investor in sustainable infrastructure, and already has well over 2GW of clean energy being prepared for construction in South Eastern Europe. As well as the VIFOR wind farm, projects include Dama Solar in western Romania which, at 1,044MW, will be the largest solar plant anywhere in Europe once it is built, the 600MW Dunarea East & West Wind Farms in Romania’s Constanța County, and St. George, a 229MW solar project in north-eastern Bulgaria.

Rezolv Energy & Low Carbon sign finance facilities for up to €291 million to build the VIFOR wind farm in Romania

Bucharest, 13 June: Rezolv Energy and Low Carbon, through their project subsidiary First Looks Solutions S.R.L., have secured finance loan facilities of up to €291 million to support the Phase 1 construction of the ‘VIFOR’ wind farm, a major project located in Romania.

The financing received resounding support by the financing community. The consortium of eight lenders was led by Erste Group, UniCredit Group and the European Bank for Reconstruction and Development, as well as the International Finance Corporation (IFC), Intesa Sanpaolo Group, OTP Bank, Raiffeisen Bank International AG and Garanti BBVA Romania.

This landmark transaction is the first financing for Rezolv Energy, which was launched 18 months ago by Actis, a leading global investor in sustainable infrastructure, to build a multi-gigawatt portfolio of onshore wind and solar parks in Central and Southeastern Europe.

Phase 1 of the VIFOR project will install 192MW in capacity underpinned by five landmark commercial power purchase agreements (PPAs). Construction is scheduled to be completed within 18 months, with the wind farm coming onstream before the end of 2025. A planned expansion to 461MW will take place in Phase 2.

Once fully operational, VIFOR, which is located in Buzău County, north-east of Bucharest, will be one of Europe’s largest onshore wind farms. Close to the Carpathian Mountains and benefiting from exceptional wind yields, the project will generate enough clean energy to power more than 270,000 homes and will avoid approximately 540,000 tonnes of CO2e annually. The project will support Romania in meeting its climate targets and play an important role in the region’s energy transition.

In approving the loans, the banks acknowledged Rezolv’s commitment to sustainability, which has been built on industry best practice and aligns with international standards, including the Equator Principles and IFC’s Performance Standards on Environmental and Social Sustainability. One of its pillars is striving to ensure that each of its renewable energy plants supports flourishing and sustainable ecosystems.

In addition to the environmental benefits, VIFOR will create local jobs both during construction and operation, deliver economic benefits to the local community, and support community initiatives in Buzău County aimed at ensuring that the project leaves a lasting, positive legacy for local people.

Alastair Hammond, CEO, Rezolv Energy, said: “We are delighted to have secured this support from such a prestigious group of supranational lending partners, regional commercial lenders and local banks. Their support is recognition of the vital role of large-scale projects like VIFOR in the energy transition in Southeastern Europe. They are also a response to our sustainability strategy, which is designed to ensure that we set a standard for the responsible development of renewable energy projects in this region which others will be inspired to follow. That was an important factor for all of the banks.”

Rezolv already has well over 2GW of clean energy being prepared for construction in Southeastern Europe. As well as the VIFOR wind farm, projects include Dama Solar in western Romania which, at 1,044MW, will be the largest solar plant anywhere in Europe once it is built, the 600MW Dunarea East & West Wind Farms in Romania’s Constanța County, and St. George, a 229MW solar project in north-eastern Bulgaria.

What is driving the interest in PPAs that we are seeing from the automotive sector?

The first few articles in this series included some analyses of individual countries in Central and South Eastern Europe – specifically, Bulgaria, Romania and the Czech Republic.

It is now time for the first of several deep-dives into industry sectors which are heavily impacted by the energy transition – and which are driving most of the demand for renewable energy power purchase agreements (PPAs) in this region. We are going to start with an industry which has become almost synonymous with Central and South Eastern Europe: the automotive sector.

- How important is the automotive industry to Central and South Eastern Europe?

Over the last 30 years, Central and South Eastern Europe has become a key centre for automotive production in Europe – benefitting from its geographical proximity to the largest markets in Western Europe and relatively low labour costs. It continues to play an outsized role economically, with Slovakia, Romania, the Czech Republic and Hungary all in the top five countries in the EU when it comes to the proportion of jobs which are created directly by the automotive sector:

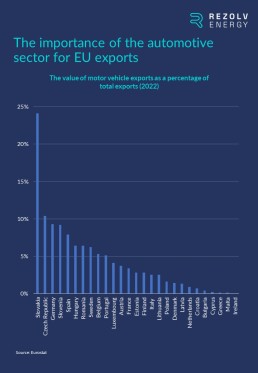

The economic value is not just in the jobs the sector supports: the industry is also a vital part of international trade in these countries. For example, motor vehicles make up almost a quarter of the total value of exports from Slovakia, and contribute a very substantial proportion in the Czech Republic (10.4%), Slovenia (9.2%), Hungary (6.4%) and Romania (6.4%) too:

- Which companies dominate the automotive sector in Central and South Eastern Europe?

There is a long list of automotive companies with production and/or assembly plants in Central & South Eastern Europe:

The list is dominated by the biggest names in the industry – including all of the world’s top five automotive companies: Volkswagen (Czech Republic, Hungary, Poland and Slovakia), Toyota (Czech Republic and Poland), Stellantis (Hungary, Poland, Serbia and Slovakia), the Mercedes-Benz Group (Hungary and Poland) and Ford (Romania).

However, as we explained in the last article in this series, the reason that the automotive sector contributes so much economically is not just explained by the presence of these multinational giants. It is also a consequence of the huge number of smaller local firms in their supply chains.

- What sustainability commitments have these companies made?

If we narrow it down and focus in on the biggest brand names from the list above (which primarily means the passenger car manufacturers), they have all committed to firm decarbonisation deadlines:

As we also explained last time, many of these targets cover ‘Scope 3’ (the entire supply chain) as well as ‘Scope 1’ (the company’s direct greenhouse gas emissions) and ‘Scope 2’ (the emissions caused indirectly through the production of the energy the company purchases / uses). This is a positive development because Scope 3 emissions represent 80% of the total environmental impact for many large companies. However, it is also a major challenge in Central and South Eastern Europe, where there are so many smaller companies supplying these multinationals. To hold on to those contracts, these businesses will need to contribute to their customers’ carbon neutrality targets by reducing their own emissions – and demonstrate that they have done so.

- Has this yet translated into automotive firms signing green PPAs?

With the transport and mobility sector accounting for about 23% of global energy-related greenhouse gas emissions, the automotive sector has been under heavy pressure to reduce its carbon footprint to comply with the Paris Climate Agreement – and, compared with other sectors, the automotive industry has set relatively stretching net zero targets.

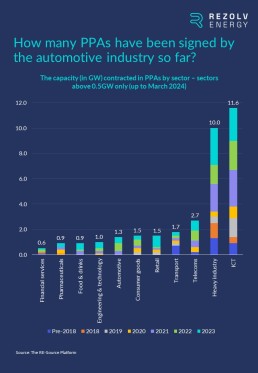

However, despite that, the sector is lagging behind several others when it comes to the amount of capacity that has so far been contracted through green PPAs:

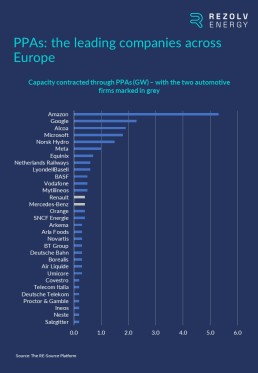

Indeed, at a European level, there are only two automotive companies – Renault and the Mercedes-Benz Group – in the group of 30 companies which have contracted the most clean power capacity through PPAs:

Mercedes-Benz was actually was actually amongst the very first movers on PPAs. The company signed its first PPA in 2018, agreeing to buy electricity generated at a 45MW wind farm 10 kilometres away from its manufacturing facility in Jawor, Poland. That was simultaneously the first PPA in this region and the first automotive sector PPA anywhere in Europe.

At the very beginning of 2019, Mercedes-Benz went on to sign Germany’s first corporate PPA, and, last year, two further (much larger) PPAs in its home market – for 140MW and 120MW, both wind power. In February this year, Mercedes-Benz also signed another wind PPA in Poland.

Renault, on the other hand, has preferred a mix of wind and solar PPAs. In 2021, the company signed a PPA with Iberdrola covering 100% of Renault’s electricity needs in Spain, which included the implementation of photovoltaic and wind projects at the company’s facilities. Subsequently, in November 2022, Renault announced the largest corporate PPA ever signed in France – 350MW of solar, enough to cover up to 50% of the electricity consumption of its production activities in France in 2027.

- 2024 will be the year when things start to accelerate – but what is driving the interest we are now seeing in PPAs in the automotive sector?

So far, there has been far less movement on PPAs from the automotive sector in Central and South Eastern Europe, but there have been two recent deals:

- Photon New Energy Alfa Kft signed a 20-year on-site PPA with FORVIA Clarion Hungary, a subsidiary of the automotive technology firm FORVIA, for the construction and operation of a solar PV plant on the client’s factory in Nagykáta, about 80 kilometres southeast of Budapest.

- Swiss-based Axpo signed a 10-year PPA with industrial product supplier Kolektor to buy up to 200 GWh of renewable electricity over ten years. The electricity will be used at Kolektor Mobility’s facility in Slovenia, which produces components and systems for electric vehicles.

This is an encouraging sign that things are changing, and that 2024 will be a transformative year. There are three other reasons why we are so optimistic about the outlook for this year:

- Decisions over renewable power cannot be deferred if the sector is to meet its decarbonisation commitments:

Automobile assembly and parts manufacturing are energy-intensive processes that rely on electricity in particular. This is responsible for considerable CO2 emissions which is why renewable energy procurement will need to play a central role if the major automotive companies present in this region are to meet their decarbonisation targets. Given the deadlines, these are also not decisions which can be delayed much longer.

- Automotive companies prefer PPAs:

As we have seen, PPAs in the automotive sector have really started to take off over the last three years in Europe. As a recent analysis of the PPA market in the automotive sector from SP Global concluded, “car manufacturers in the EU and US largely prefer PPAs, with green tariffs following. The automotive sector began to confidently gain momentum in the PPA market in North America and Europe. Its average annual growth in 2019-22 reached 50%, which makes it stand out compared with other manufacturing sectors.”

- Available capacity:

That same SP Global analysis made one other very important point. It said that “the rate of progress in green procurement across major car manufacturers appears to be closely dependent on…the renewable generation capacity in the region where manufacturing plants are present.”

Fortunately, renewable energy capacity is now coming onstream in volume in Central and South Eastern Europe and so, really for the first time, the energy sector can meet the corporate demand for green electricity from automotive firms.

What is coming up next time?

Next time, we will be taking another sector deep-dive – this time into the telecoms industry…

Even more urgency is required to meet the 2030 emissions targets in Central & South Eastern Europe

In the first two parts of this series, we explained why Rezolv is investing in Bulgaria and Romania. We focused on the impact that the development of renewable energy will have on emissions and human health. We also outlined why the energy transition is necessary for long-term economic competitiveness.

However, there is one other aspect we didn’t consider which is also driving change: large-scale renewable energy projects like those Rezolv is developing in Romania and Bulgaria will contribute to both countries’ climate targets.

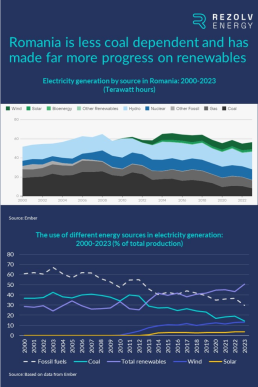

Let’s consider Romania first. Last time, we mentioned that the percentage of electricity generated from fossil fuels in Romania dropped below 30% for the first time in 2023, with overall renewables capacity increasing from 43.1% in 2022 to 50.4%. 65% of that renewables capacity was hydropower, but we shouldn’t understate the progress that was made last year, particularly on solar power. As in Bulgaria, 2023 was the year when Romanian solar turned the corner, with over 1GW of new capacity installed, a 308% increase on 2022 – making solar PV the fastest-growing power source in the country.

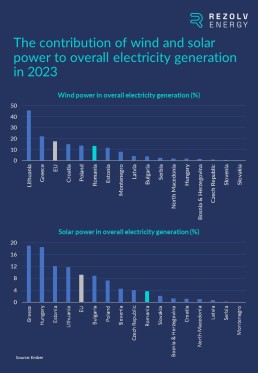

To put that into a regional context, here’s how Romania stacked up against other countries in Central & South Eastern Europe in 2023 in terms of both wind and solar capacity:

Wind capacity also increased very slightly last year in Romania – but from a much higher starting point. On both fronts, though, there is more work to do to reach the EU average, let alone catch the countries that are leading the way in the region.

Romania’s renewable energy target keeps increasing

It’s also worth considering the progress made in 2023 against Romania’s 2030 renewable energy target. The reality is that its impact was diluted by the fact that that target has been steadily increasing as the EU’s level of ambition has risen.

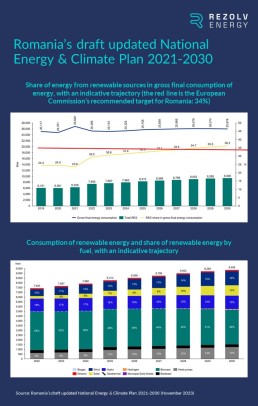

Romania’s Integrated National Energy and Climate Change Plan (NECP) for 2021-2030, which was submitted to the European Commission in 2018, set a target for the total share of renewable energy in final gross energy consumption of 27.9% by 2030.

The revised NECP, submitted in April 2020, increased that target to 30.7% – short of the Commission’s recommendation of at least 34%, but still a significant increase.

Most recently, the revised draft of the NECP that was submitted in November 2023 indicated that Romania could reach 36% by 2030 – with wind and solar the main contributors:

Attitudes are also being shaped by the renewable energy potential in the region

Romania’s increased ambition is not just a response to pressure from the European Commission: it’s also driven by Romania’s enormous renewable energy potential. For wind power, there are exceptional natural resources in some parts of the country, particularly in Constanța county where Rezolv’s 600MW Dunarea East & West wind farms will be built. But it’s not only along the Black Sea coast. Rezolv’s other onshore wind project in Romania, VIFOR, is in Buzău county, more than 200km inland – where the proximity to the Carpathian Mountains also gives rise to high wind yields.

The solar potential is huge too. Romania joined the International Solar Alliance during COP28. In making the announcement, Energy Minister Sebastian Burduja estimated the country’s technical solar potential at 19.35GW (25.80 TWh), with 18.05GW (24.18 TWh) deemed economically viable under minimum cost scenarios. These are not small numbers, and it’s primarily, obviously, because the whole of South Eastern Europe enjoys plenty of sunshine.

It’s also about available land, though. Very large-scale solar projects like those Rezolv is developing require large, flat sites (as well as good solar irradiation and grid access). Our 229MW St. George project in Bulgaria, for example, will cover 165 hectares. Dama Solar, our 1,044MW solar project in western Romania, will be significantly larger than that.

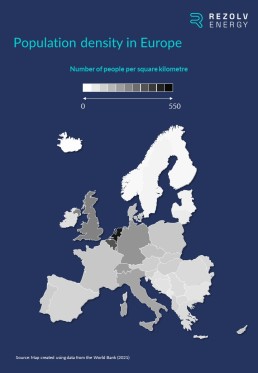

Sites of that size are clearly not available everywhere, but they are a bit easier to find in Central & South Eastern Europe than some parts of Western Europe – because it is not the most densely populated part of Europe:

Bulgaria: a case study of how broader government priorities are driving the energy transition

Political attitudes in Bulgaria also illustrate the fact that EU targets are not the only driver of change in this region.

Ahead of the unveiling of the EU’s climate target for 2040, 11 member states jointly called on the EU to set “an ambitious climate target for 2040…[which] should be in line with the long-term temperature goal of 1.5°C… The target should also ensure that the EU is fully on track to climate neutrality by 2050 at the latest aiming to achieve negative emissions thereafter.”

Bulgaria was the only Central & Eastern European country in the group of 11 member states that signed that letter. Why Bulgaria?

In part, it is the same factors that are driving the commitment to the energy transition across this region: the need to secure energy supplies, enhance energy independence and drive down energy prices – all of which have become political priorities everywhere since the start of the war in Ukraine.

As in Romania, it is also an acknowledgement of the renewable energy potential in Bulgaria. For example, Bulgaria is on track to achieve its 2030 NECP target for solar power about seven years ahead of schedule, and a recent study from the Centre for the Study of Democracy found that Bulgaria could add between 3.8GW and 4.2GW of wind capacity by 2030, and another 5GW by 2040; offshore wind could add more than 150GW on top of that.

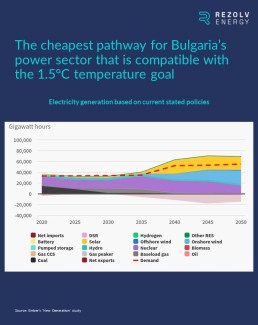

Indeed, based on a study by Ember, the cheapest pathway for Bulgaria’s power sector which is compatible with the 1.5°C temperature goal mentioned in the letter involves the installation of huge amounts of solar and onshore wind:

And it’s not just the EU member states…

We are seeing similar levels of commitment to renewables from non-EU member states in the region as well. For example:

- By 2030, North Macedonia has committed to reducing its net greenhouse gas emissions by 82% compared to 1990 levels. The energy transition will be key to achieving this given how dependent the country has historically been on coal. This commitment is already being backed up by action. Last year, North Macedonia posted 160% growth in new renewables capacity and, at COP28, announced a coal phase-out by 2030.

- Under its draft NECP, Serbia will, by 2030, aim to increase the share of renewables in electricity production to 45.2% and deliver a 40.3% reduction in greenhouse gas emissions compared to 1990.

- Bosnia & Herzegovina aims to deliver a renewable energy share of 43.6% by 2030, most of which will be solar.

Renewables targets will continue to grow – which also represents a big, but not insurmountable challenge

Countries in Central & South Eastern Europe are not purely motivated by the requirement to meet climate targets, but, at the same time, no one is in any doubt that the pressure from Brussels will only continue to increase.

Indeed, on 6 February 2024, the European Commission published a detailed impact assessment on possible pathways to reach the agreed goal of making the EU climate neutral by 2050. Based on the assessment, the Commission expects renewable energy, “complemented by nuclear energy”, to generate over 90% of the electricity consumption in the EU in 2040. A legislative proposal will be made after the European elections, and it will need to be agreed with the European Parliament and member states – but even a watered-down version of this proposal will translate into more ambitious renewable energy targets for every member state.

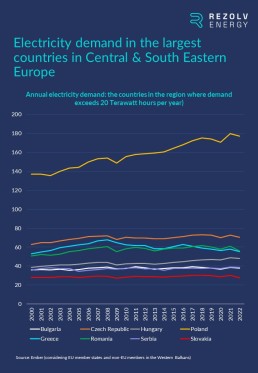

This will be particularly challenging for the largest and most heavily industrialised countries. If you take ‘Central & South Eastern Europe’ to mean the EU member states in the region plus the non-EU countries in the Western Balkans, there are only four countries where annual electricity demand exceeds 50 Terawatts – Poland, the Czech Republic, Romania and Greece:

In these countries, increasing the share of renewable energy is a bigger challenge than it is in smaller countries, because each percentage point represents more gigawatts of renewable capacity.

Summing up: significant progress has been made over the last 12 months, but even more urgency is needed

The political support we are seeing for renewable energy is, of course, not only a consequence of ever-increasing EU targets – but those targets certainly do help focus minds. The truth is that 2030 is not very far away, and large-scale renewable energy projects – the quickest and most effective route to meeting those targets – take time to develop. The progress we have seen across the region over the last 12 months is a great start, but even more urgency is needed.

What is coming up next time?

Some countries’ 2030 targets look tougher to achieve than others’, and next time we are going to be looking at one member state which still has plenty to do: the Czech Republic…

The Czech Republic’s 2030 renewables target will only be achievable with rapid, widespread and coordinated policy change

In the third part of this series, we looked at the 2030 renewable energy and emissions reduction targets that are in place across Central and South Eastern Europe. We concluded that 2030 is not very far away and even more urgency is needed if there is a realistic chance of meeting them.

That statement is true across the board, but there are some countries where the mountain to climb looks particularly steep. The Czech Republic is one of those countries.

The current energy mix in the Czech Republic

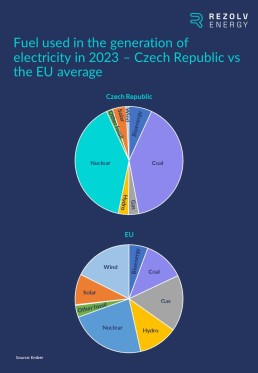

Let’s start by quantifying the scale of the challenge. Last year, 40% of the electricity generated in the Czech Republic was produced from coal, more than three times the EU average:

The contribution from renewable sources – hydro power, bioenergy, wind and solar – represented just under 15% of the total, comfortably the lowest proportion anywhere in the EU:

That share is only four percentage points better than a decade ago, but half of that extra renewable energy capacity has been added in the last 12 months, mostly from rooftop solar:

The 2030 renewables target has been increasing steadily – and is about to go up again

Now consider the target the Czech Republic has set itself for the share of renewable energy in gross final energy consumption by 2030. It’s a target which has been steadily increasing:

- Target set in December 2018: 20.8%

This was the figure submitted to the European Commission by the Czech government in the first National Energy and Climate Plan (NECP). To put this in context, the EU target was 32% at that point.

- Target set in November 2019: 22%

The final NECP increased the target to 22%, but the European Commission still described that as “unambitious”.

- Target set in October 2023: 30%

The draft updated NECP submitted in October proposed a very significant increase, reflecting the fact that the EU’s overall 2030 target had risen to 42.5%. At the time, the Ministry of Environment clarified that this would mean 10GW of installed capacity from solar and 1.5GW from wind by 2030 – almost five times the amount installed up to that point.

- The revised target which is about to emerge: ?%

We are still waiting for the New State Energy Concept and Climate Protection Policy, but the 30% target is going to increase again. Some reports have recently suggested that it could even go up to 37%, but that feels over-optimistic. 33% seems more likely, but even that would represent a significant increase on October’s revised target.

How will this challenge be met? The three top priorities…

This level of ambition from the government is, of course, very welcome. It reflects a degree of political will to support the energy transition which hasn’t been in place since the ‘solar boom’ of well over a decade ago.

However, no one in the sector is in any doubt about the scale of this challenge. Even the current 30% target represents a doubling of renewables capacity in six years (and, as mentioned, the new target will be even higher than that). Whatever the final number, there is no way that it can be delivered without rapid, bold and comprehensive policy-making.

The government will need to do many things, but based on our experience from across the region, there are three areas that it will need to address with particular urgency:

- Prioritise large-scale renewables projects

There is no prospect of meeting a 30+% renewables target without utility-scale wind and solar projects – which are also proportionately cheaper and deliver the lowest cost of electricity for everyone.

Large projects require space, of course, and there is a common misconception in the Czech Republic that space is one thing the country lacks. This isn’t true. There is plenty of available publicly-owned land that would be suitable for major renewables projects, for example. Up to now, the issue has been a lack of political will, not available land. We are very hopeful that, with the political will now in place, we will start to see progress in this area.

But things will need to move forward very quickly, because large-scale renewables projects take time to develop and build. In the context of major infrastructure development, six years is not a long time.

- Serious investment needs to be made into the grid

Significant investments also need to be made into grid capacity and flexibility to support the volumes of clean power that will be coming onstream. This is well understood and acknowledged within government and across the sector.

The numbers are substantial. The Chairman of the Czech Energy Regulatory Authority (ERÚ) recently estimated the investment needed into the transmission and distribution system at 271 billion crowns (€10.7 billion) by 2030. Not all of that is directly related to the development of green energy, but it is an indication of the kind of money that will need to be found.

Joined up policy-making will be required here too. For example, the windiest areas of the Czech Republic are, mostly, not currently connected to the grid. Decisions over the location of acceleration zones for future renewables projects therefore need to come first, based on which the necessary grid investment plans can be drawn up.

- Introduce a CfD scheme to include larger renewables projects

In October, the EU Council agreed a general approach on a proposal to amend the EU’s electricity market design – which will, in due course, need to be transposed into Czech law. One of the reform’s objectives is to accelerate the deployment of renewables. There are two areas that are particularly important for developers:

First, the reform aims to boost the market for power purchase agreements (PPAs). The European Commission has now been tasked with identifying barriers to cross-border PPAs and with developing best practice and a template contract to accelerate the growth of this market across the EU.

Second, it has been agreed that two-way contracts for difference (CfDs) should, in most cases, be the mandatory model used when public funding is involved to support renewables projects. CfDs are long-term contracts concluded to support investments. They top up the market price when it is low, with the energy producer paying back an amount when the market price is higher than a certain limit. CfD schemes provide predictability and certainty for developers and have been successfully used elsewhere in Europe – for example, in the UK, Germany and Poland. Other countries, including Romania, are about to introduce them.

The Czech Republic has launched auctions on a small scale, but only for biogas plants, small hydropower plants and wind farms. However, the total capacity of power plants that can be entered into auctions is severely limited and there is no auction for solar plants. The Czech government must make a CfD scheme for larger renewable energy plants – both wind and solar – a central pillar of its strategy to accelerate the energy transition.

Let’s not forget the human dimension of the energy transition in the Czech Republic

Targets are important, but they are obviously not the real objective. The real goals are much more meaningful: to secure energy supplies and enhance energy independence, to foster economic competitiveness and to reduce energy bills.

It is also about safeguarding – and, ultimately, improving – the quality of people’s lives.

On one level, that means protecting jobs. To understand this, it’s important to grasp how corporate sustainability targets have evolved. Initially, they mostly focused on reducing the company’s direct greenhouse gas emissions (‘Scope 1’) and emissions caused indirectly through the production of the energy it purchases / uses (‘Scope 2’). Subsequently, in more recent years, hundreds of international companies have gone much further and have also publicly committed to carbon neutrality along the entire production chain (‘Scope 3’ emissions). Scope 3 emissions represent 80% of the total environmental impact for many large companies, and this is becoming a major issue for the Czech Republic, one of the most heavily industrialised countries in Europe, where there are a huge number of small firms in the supply chains of multinational companies with Scope 1-3 net zero targets.

If these businesses want to hold on to those important contracts, they will need to reduce their own emissions – and demonstrate that they have done so. For them, sourcing clean power is not just about sustainability: renewable energy PPAs are going to become vital to their ongoing viability, and therefore to the livelihoods of the people they employ.

The human dimension of the energy transition is bigger than jobs, though – it’s also about public health. In the first two articles, we considered the air pollution problem in Bulgaria and Romania. The issue is not identical in the Czech Republic, but it’s no less important – and it’s worth exploring in some detail because the Czech Republic is a useful case study of why the transition to renewable energy is so important for ordinary people.

Given how industrial the Czech Republic is, and given the country’s track record on renewables, it’s no surprise that it is, per capita, one of the biggest emitters of greenhouse gases in Europe:

As we saw in Romania and Bulgaria, this creates pollution which has a direct impact on the health of the general public.

It doesn’t affect every part of the country equally, though. Just under a year ago, the European Environment Agency (EEA) published air quality assessments for 375 cities across the EU. The assessments focused on pollutants deemed to be most harmful to human health – one of which is fine particulate matter (PM2.5). We considered PM2.5 in the first article in this series because exposure at above recommended levels is a leading cause of premature death and disease (particularly stroke, cancer and respiratory disease). In Central & South Eastern Europe, high levels tend to be due primarily to the burning of solid fuels such as coal.

For long-term exposure, the WHO recommends a maximum level of five micrograms per cubic metre (μg/m3) of fine particulate matter. The EEA categorised cities as “poor” where average levels of PM2.5 over the previous two calendar years had been 15-25 μg/m3; “very poor” required average levels above 25 μg/m3.

Only four of the 375 EU cities assessed were evaluated as “very poor”; 77 were categorised as “poor”. When you look closely at those 81 cities, there are five ‘clusters’ where there are at least three “poor” or “very poor” cities in the same regions of the same country. One of these clusters is in the Czech Republic – specifically, the far eastern corner of the country. Out of 15 Czech cities assessed, five had “poor” air quality: Havířov, Ostrava, Olomouc, Zlín and Hradec Králové. Havířov, Ostrava, Olomouc and Zlín – the four most polluted Czech cites assessed – are in Central Moravia and Moravia-Silesia, the country’s easternmost regions (marked light blue on the map below):

Fixing this problem is one of the primary objectives of the clean power transition and should focus minds on the urgency of the challenge.

Summing up: a lot to do in a short period of time

The Czech government’s willingness to keep increasing the 2030 renewables target is an encouraging sign of the political will that now exists to speed up the transition away from fossil fuels, but 2030 is not far away. If the new target – whatever it ends up being – is to be met, policy-makers need to be bold, and to act fast. 2024 will be a crucial year for the energy transition across the whole of Central and South Eastern Europe, but nowhere more so than in the Czech Republic.

What is coming up next time?

Next time, we will be taking a deep-dive into a sector which is not only of vital economic importance to Central and South Eastern Europe, it is also generating much of the demand for renewable energy PPAs: the automotive industry…

Why is Rezolv investing in Romania?

We recently kicked off this series of articles on the clean energy transition in Central & South Eastern Europe by answering the question: why is Rezolv investing in Bulgaria?

By the time we announced St. George, our 229MW solar PV project in north-eastern Bulgaria, we had already confirmed that we would be building more than 2GW of clean power in Romania, through three separate projects: Dama Solar, a 1,044MW plant in north-west Arad County, which will be the largest solar project anywhere in Europe once it is operational; the Dunarea East & West wind farms in Constanța County which, at 600MW, will become one of Europe’s largest onshore wind projects; and the 450MW VIFOR wind farm in Buzău County. The wind farms are being developed by Rezolv in partnership with Low Carbon.

So, let’s now consider Romania in more detail: why is Rezolv investing there?

An ‘emissions first’ approach in Romania too?

For Bulgaria, we talked about an ‘emissions first’ approach: Bulgarian electricity production is still heavily dependent on fossil fuels – specifically brown coal, or lignite, which causes the highest CO2 emissions per ton when burned, one-third more than hard coal and three times as much as natural gas. Replacing lignite production with renewables delivers the maximum possible emissions reduction impact. Does the same ‘emissions first’ rationale justify investing in renewables in Romania?

The answer is ‘yes’, but the context in Romania is a bit different.

Last year, the percentage of electricity generated from fossil fuels dropped below 30% for the first time. That’s primarily explained by the growth of renewable energy, with overall renewables capacity increasing from 43.1% in 2022 to 50.4% in 2023, comfortably the highest level it has ever been:

Doesn’t Romania’s much stronger track record on renewables undermine the ‘emissions first’ argument for investing there? No.

For two main reasons:

First, despite everything that we have just outlined, the carbon intensity of energy production in Romania – the amount of CO2 emitted per unit of energy – is even higher in Romania than it is in Bulgaria:

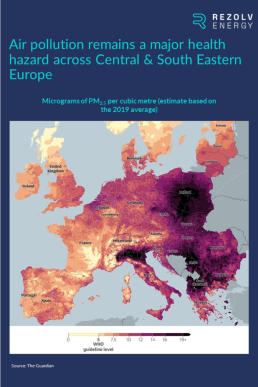

Second, air quality in Romania remains a significant problem. When we considered Bulgaria in the first article of this series, we explained that while there are many different air pollutants, one of the most significant for human health is fine particulate matter (PM2.5), because exposure to PM2.5 at above recommended levels is a leading cause of premature death and disease (particularly stroke, cancer and respiratory disease).

While average air quality is worse in Bulgaria than it is in Romania, Romania is still fourth on the EU list when it comes to premature deaths attributable to exposure to PM2.5 – behind only Bulgaria, Poland and Hungary. This map illustrates the point very clearly:

A rapid reduction in energy sector emissions will therefore have more than a significant climate impact: it will also have a direct, tangible impact on the health of the Romanian public.

The energy transition is an economic priority in Romania as well

There is one other very important area in which Romania and Bulgaria are similar. In the previous article, we showed how Bulgaria is amongst the most heavily industrialised economies anywhere in Europe. The situation in Romania is almost exactly the same, with much of Romania’s industry also integrated into the supply chains of major multinational companies – many of whom have committed to comprehensive net-zero and renewable energy targets. To remain part of those supply chains – which, in many cases, will be essential for their long-term viability – those Romanian firms will need to meet their major customers’ renewable energy consumption requirements by procuring clean power.

This reality has started to dawn on many energy-intensive companies in Romania. Creative Communication recently ran a survey of 428 Romanian companies that consume more than 10GWh of power per year, asking them for their views on procuring renewable energy through power purchase agreements (PPAs). At first sight, the results might not look overwhelmingly positive, but they are actually very encouraging:

Why is this encouraging? Because if that same survey had been run 12 months ago, there would have been far higher numbers in the “I don’t know what a PPA is” and “We know about the PPA model, but we are not interested in entering into one” categories.

How to accelerate the PPA market in Romania

It is also encouraging because some of the concerns that we know exist – specifically, in the 40% of businesses that said they were waiting for the market to mature before making a decision – can be addressed. In two main ways:

First, this problem will ease over time. The first PPA was only signed in Romania in 2021, so it is a relatively new concept. There is a change in buying habits. You are asking a company that has always bought electricity annually through an energy trader to sign a contract for a 10+ year period directly with an energy producer. It’s a big step, in terms of financial commitment but also confidence and risk appetite, and it’s therefore understandable that buyers are cautious. However, expect to see a raft of PPAs being signed in 2024 – and this, gradually, will change the game. In the meantime, the task for stakeholders in the renewable energy sector – including Rezolv – will be to continue to educate consumers and help them through this change in paradigm. As the survey shows, there is a knowledge gap but it’s also a psychological barrier more than anything else, and it can be overcome.

Second, there is one remaining regulatory barrier holding the PPA market in Romania back – which is even more straightforward to fix. This concerns Guarantees of Origin (GOs). GOs prove to a final customer that the energy they are buying was produced from renewable sources. They are a critical component of corporate PPAs. Without them, PPA buyers cannot verify the type of electricity they are using and are unable to meet strict carbon accounting requirements, or prove compliance with RE100 and SBTi rules. Crucially, for the multinational firms that are currently driving most of the demand for PPAs, GOs also need to be transferrable between EU member states.

It is this ability to transfer GOs across borders within the EU that is the problem in Romania because it is only possible if the GOs are certified by a European body called the Association of Issuing Bodies (AIB) – and Romania is one of only two member states which is not a member of the AIB or in the process of applying to join. This is a clear barrier to the development of the PPA market and the renewable energy industry in Romania, via the main trade associations, are pushing for the government to remedy it very soon. This is also important for Romania as the EU has placed access to PPAs as one of the key elements of the electricity market reform that was agreed late last year.

PPAs are not just a way for corporates to benefit from the energy transition, they are a way for them to contribute

Applying for AIB membership is the policy change which would have the biggest impact on the renewable energy sector in Romania because, as we touched on in the first article of this series, PPAs are not just about corporate off-take. They also help finance renewable energy projects, so removing barriers to PPAs is the quickest way to increase renewable energy capacity.

Explaining this connection between PPAs and project financing is an important part of the education process in Romania. Happily, the message is getting through. Increasingly, Romanian companies are understanding that the opportunity in a PPA is not just to ensure their long-term supply of clean power at a stable price. It will also help build the project that will supply them. A PPA is therefore not just a way for them to benefit from the energy transition, it is a way for them to contribute. Also, they can claim “additionality” because they are supporting renewable energy generation which is new rather than already available – so, through a PPA, they are delivering a material impact on reducing fossil generation and displacing carbon emissions.

This is particularly attractive if the off-taker knows that the project will be constructed and operated to the highest ESG standards: that the developer is fully committed to protecting nature at the project sites, and to leaving a lasting, positive legacy in the local communities.

Take Rezolv’s Dama Solar project in Arad, for example, where there will be a particular emphasis on integrating symbiotic agricultural activities. The land on which the project will be built has been over-cultivated in the past, so is now poor quality from a farming perspective. As part of the project plan, it will be returned to pasture, with sheep managing the vegetation through grazing. We are also looking to incorporate beekeeping and other measures to increase biodiversity. As with all of our projects, there will also be a long-term investment programme at Dama Solar which will go well beyond local job creation to ensure that the project creates economic value and a range of other benefits to the people of Arad. It is a project with which any corporation would be proud to be associated.

Summing up

Romania has made good progress on renewables compared to other countries in SEE. However, that does not undermine the ‘emissions first’ motivation for investing in renewables there because Romanian energy production is still carbon intensive and air quality remains poor across the country. The rapid development of the PPA market is the fastest way to expand renewables capacity. And the quickest way to release the handbrake on PPAs would be Romania announcing its application to join the AIB.

What is coming up next time?

There is one other factor which helps answer the “why Romania?” question that hasn’t been explored here: Romania has enormous renewable energy potential, which is one reason why its 2030 fossil fuel reduction and renewables growth targets remain challenging.

And in the next article in this series, this is the topic we will be exploring. Turning our attention to the whole of Central & South Eastern Europe, we will see which countries in the region have made the most progress on wind and solar, and which have the most still to do…

Why is Rezolv investing in Bulgaria?

Rezolv launched 18 months ago to accelerate the energy transition in Central & South Eastern Europe. We already have well over 2GW of clean energy being prepared for construction. This includes St. George, which will become one of Bulgaria’s largest solar plants, and Dama Solar, which will be the largest solar project anywhere in Europe once it is operational. We also have more than 1GW of wind power under construction in Romania.

When you tell people that story, it typically leads to one question: why Romania and Bulgaria?

This is the first in a series of articles that we will be publishing about the clean energy transition in Central & South Eastern Europe. We’re going to start by focusing on Bulgaria. The second article, which will be out in a couple of weeks’ time, will answer the ‘Why Romania?’ question.

An ‘emissions first’ approach.

So why Bulgaria?

There isn’t a straightforward, single factor answer to that question. There are various reasons, many of which are connected to the characteristics of the St. George project. St. George will be built on the site of the former Silistra airport, a decommissioned airfield covering 165 hectares. At 229MW, it is, like all of Rezolv’s projects, utility-scale. Solar projects of this size require a few different things – not least available land, good solar irradiation and capacity for grid access close to the site. St. George had all of these things.

But if you zoom out from the specifics of the project, there is a broader answer to the question which helps explain Rezolv’s mission – and that of Actis, Rezolv’s single shareholder. Actis is one of the world’s most respected energy investors, and one of the reasons Actis prioritised Central & South Eastern Europe is because it is a region which has historically relied on fossil fuels for most of its energy needs. Replacing fossil fuel production with renewables delivers the maximum possible emissions reduction impact – an ‘emissions first’ approach which aligns with the sustainability policies which are now being adopted by some of the world’s biggest companies, including Meta, Amazon and General Motors.

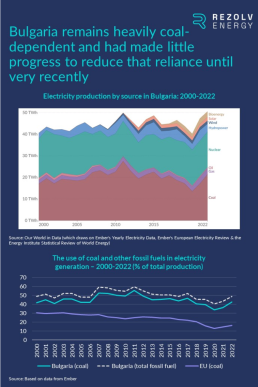

Bulgaria is a perfect example of this emissions reduction potential. Bulgarian electricity production is still heavily dependent on fossil fuels – particularly brown coal, or lignite, which makes up more than 85% of that fossil fuel total. This is a major problem because while lignite is the cheapest source of electricity from fossil fuels, it causes the highest CO2 emissions per ton when burned, one-third more than hard coal and three times as much as natural gas.

In 2022, 48.8% of Bulgaria’s electricity generation was produced by fossil fuels, almost identical to the situation in 2000 – so limited progress was made in the 20+ years leading up to 2022 in reducing Bulgaria’s dependence on lignite:

One explanation for this is that, over the same period, Bulgaria made limited progress in developing wind and solar capacity. Bulgaria was a relatively slow-starter on renewables: wind power was introduced, in small quantities, in 2006; solar production only got going in 2010. Both industries experienced a ‘boom’ between 2010 and 2013, but after that, the ‘pause’ button was pushed on new renewables capacity for a decade:

The good news is that the wheels are now turning and the energy transition is well underway in Bulgaria – in particular on solar, where capacity increased by more than 80% in 2023:

The energy transition is an economic as well as a political priority

This progress on solar establishes the extent to which the energy transition has become a political priority. The main drivers are obvious. First, the need to enhance energy security by reducing dependence on foreign sources of energy has, of course, risen to the top of the political agenda since the start of the war in Ukraine. And second, Bulgaria has some challenging climate targets to hit (a topic we will be returning to later in this series).

But there is also a third, slightly lower-profile factor: accelerating the energy transition has become an economic imperative too. Bulgaria is amongst the most heavily industrialised economies anywhere in Europe:

Later in the series, we will explore this factor in more detail, but for now, it is sufficient to note that much of Bulgaria’s industry is integrated into the supply chains of major pan-European industrial businesses. More and more of these multinationals are committing to comprehensive net-zero and renewable energy targets. However, in most cases, they have moved faster in this area than the majority of their suppliers – who will need to catch up quickly and meet their major customers’ renewable energy consumption requirements if they are to hold on their contracts. Enabling Bulgarian companies to procure clean power will therefore be vital to their long-term viability – and to the economic competitiveness of the country as a whole.

The PPA potential in Bulgaria

For this reason, the news just before Christmas that the Bulgarian Sustainable Energy Development Agency (SEDA)’s application to join the Association of Issuing Bodies (AIB) had been accepted was hugely welcome. This concerns guarantees of origin (GOs), which prove to a final customer that the energy they are buying has been produced from renewable sources. AIB membership is necessary for GOs to be transferred between EU member states, which is essential for many of the multinational firms that are driving the demand for power purchase agreements (PPAs). AIB membership will therefore remove a key barrier to the signing of corporate PPAs in Bulgaria – which will also lead to more renewable energy projects being built there.

The impact of renewable energy on the Bulgarian public

Finally, let’s not forget the impact of renewable energy on the general public. In Bulgaria, the growth of wind and the further development of solar will have a direct, tangible impact on human health, which is another reason why investing there is so attractive. This is specifically because air quality remains a huge problem. There are many different air pollutants, but one of the most significant for human health is fine particulate matter (PM2.5), with exposure to PM2.5 at above recommended levels a leading cause of premature death and disease (particularly stroke, cancer and respiratory disease).

PM2.5 levels are a serious problem across the whole of Central & South Eastern Europe. Across the region, the European Environment Agency concludes that high PM2.5 levels are “due primarily to the burning of solid fuels like coal for domestic heating and their use in industry”. And it’s a killer – with Bulgaria number one on the EU list when it comes to premature deaths attributable to exposure to PM2.5:

This focus on the human dimension of the energy transition translates to local community relations as well. Rezolv has always taken the view that, without the support of the communities that live close to our sites, we would not be able to build and operate our projects successfully. Leaving a lasting, positive legacy for local communities is more than just the right thing to do: it’s business critical. We are therefore committed to creating long-term value for the communities living around St. George by working with local stakeholders to create opportunities and improve living standards for local people – both current generations and those to come. In so doing, we intend for St. George to set a standard for the responsible development of renewable energy projects in Bulgaria which others will be inspired to follow.

Summing up

So, to sum up, why are we investing in Bulgaria? Because the development of renewable energy will have a tangibly positive impact on human health there. And because the energy transition is at the heart of Bulgaria’s ongoing industrial competitiveness, with PPAs offering Bulgarian companies an emissions reduction guarantee – as well as long-term price stability and peace of mind over the security of supply. On top of that, PPAs help finance the construction of new renewable energy projects. It’s a virtuous circle.

What is coming up next time?

Is this context the same in Romania? Not exactly. There is still an ‘emissions first’ rationale for investing there, but the investment case is not identical.

And that is what we will be exploring next time…

Rezolv Energy acquires rights to develop Bulgaria’s largest solar plant

- The 165-hectare, 229 MW installed capacity plant, acquired from YGY Industries JSC, will be situated in Silistra Municipality in north-eastern Bulgaria

- Named ‘St. George’, the plant is expected to be online in early 2025; its installed capacity will be equivalent to 13% of Bulgaria’s current solar energy production

- Rezolv Energy already owns more than 2GW of clean energy being prepared for construction in Romania, including what will be Europe’s largest solar project

Rezolv Energy, an independent renewable energy producer focused on Central and Southeastern Europe, has acquired the rights to build and operate a 229 MW solar plant in Silistra Municipality in north-eastern Bulgaria. Named ‘St. George’, construction is due to start before the end of this year; the plant is expected to be completed in early 2025. Once constructed, it will be the largest solar plant in Bulgaria.

Rezolv has acquired the project from Bulgarian company YGY Industries JSC, owned by Mr. Yavor Georgiev.

St. George will be built on the site of the former Silistra airport, a decommissioned airfield covering 165 hectares. The project will comprise nearly 400,000 solar panels. With an average annual power generation of 313 Gigawatt hours (GWh), it will produce the equivalent of 13% of Bulgaria’s currently-installed solar power.

The plant will be connected to the main 110 kV transmission grid via two independent connection lines totalling about 6 kilometres in length. The power will be sold to commercial and industrial users through long-term Power Purchase Agreements.

The project will create a large number of new jobs in the construction phase. Approximately 500 Full Time Equivalent (FTE) employees will be hired, both for light assembly – which is work suitable for men and women, on both a full-time and part-time basis – and highly-skilled engineering roles. Longer term, the power plant will provide local employment for skilled and semi-skilled labour throughout the 30 plus years of operation.

St. George will be designed, constructed, and operated to the highest environmental, social and governance (ESG) standards.

Rezolv Energy was launched last year by Actis, a leading global investor in sustainable infrastructure. Rezolv already has more than 2GW of clean energy being prepared for construction in Romania, including the 1,044 MW Dama Solar project, which will become the largest solar plant in Europe once it is operational.

“Solar will make up almost 13% of Bulgaria’s total installed capacity this year, and estimates suggest that close to 6GW of solar power will be generated by 2030. We are very proud that St. George will be such a major part of that growth story. It will help Bulgaria meet its renewable energy targets and contribute to its energy independence. Crucially, for the business sector, it will also enable us to provide highly competitive, subsidy-free clean power at a stable price for industrial and commercial users right across the country.”

– Alastair Hammond, Chief Operating Officer

“Rezolv continues to go from strength to strength and we are delighted to be funding its investment in such an important project. Actis’ ambition is to make a substantial contribution to the Energy Transition in this region through major, large-scale projects which are constructed and operated to the highest sustainability standards. St. George is exactly the kind of project we had in mind when we took the decision to back Rezolv.”

– Jaroslava Korpanec, Partner and Head of Central & Eastern Europe at Actis

Rezolv announces 600MW of new onshore wind capacity in Romania

- New Adamclisi & Deleni wind farms will create one of Europe’s largest onshore wind projects

- Project is Rezolv’s third major deal since launching in August 2022

- Rezolv now has more than 2GW of wind and solar power in development

Rezolv Energy, an independent clean energy power producer focused on sustainable power in Central and South Eastern Europe, has announced its third significant deal since it was established in August 2022.

In partnership with Low Carbon, Rezolv will construct two onshore wind farms in Romania with a combined capacity of up to 600MW. Together with Rezolv’s recently announced 450MW Vis Viva wind farm and 1,044MW Arad solar farm, the business now has more than 2GW of renewable energy projects in late-stage development.

Sharing the same grid connection point, the two new wind farms will be located in the communes of Adamclisi & Deleni in Romania’s Constanta county. The sites will benefit from the region’s exceptional natural wind resources, flat terrain, and energy interconnection. Once operational, the wind farms will generate enough clean energy to power more than 332,000 homes and avoid approximately 220,000 tonnes of CO2e annually, making a significant contribution to both Romania’s and the European Union’s environmental targets for 2030 and 2050.

Low Carbon has been stewarding the Adamclisi & Deleni projects since 2020, when the investor first entered the transaction with local developers and Nero Renewables NV. Rezolv has now acquired a 51% stake in the projects, which are expected to reach financial close during the second half of 2023.

Rezolv launched earlier this year, backed by €500m from Actis, a leading global investor in sustainable infrastructure. The company aims to build a multi-gigawatt portfolio of wind, solar and energy storage across Central and South Eastern Europe, taking renewable energy projects from late-stage development through construction and into long-term operation. It will provide subsidy-free clean energy at a long-term, stable price for commercial and industrial users, and other off-takers, operating across the region.

“Companies and governments around the world are increasingly favouring the adoption of clean, cost-effective and quick-to-build renewable energy. With over 2GW of renewables now in development, we are proud to play a crucial role diversifying and increasing security of supply, while reducing central and eastern Europe’s dependence on non-renewable energy sources.”

– Jim Campion, Chief Executive, Rezolv Energy

“The central role of renewable energy in mitigating climate change is undeniable, and was a focal point of the recent COP27 summit in Sharm el-Sheikh. With wind and solar power set to provide two-thirds of global power generation by 2050 in long-term Paris-compliant energy scenarios, our latest project is set to make an important contribution to the continent’s energy transition, and its ambitious net-zero targets. The Adamclisi & Deleni projects will also make a significant contribution to Low Carbon’s own ambition to build 20GW of new renewable energy capacity, and achieve net zero, by the end of the decade.

We are delighted to deliver the project in partnership with Rezolv Energy, as part of our shared commitment to generating sustainable investments at scale for the benefit of future generations.”

– Roy Bedlow, Chief Executive at Low Carbon

“This announcement demonstrates our commitment to back Rezolv’s ambition to build a multi-gigawatt portfolio of wind, solar and energy generation over the next few years, helping companies and communities across the region meet their energy needs through clean, renewable energy generation that supports Net Zero targets.”

– Jaroslava Korpanec, Partner and Head of Central & Eastern Europe at Actis

Rezolv acquires rights to develop Europe's largest ever solar photovoltaic plant

- Actis backed Rezolv Energy was launched earlier this year to build a new era of sustainable power in Central and South-Eastern Europe

- 1,044 MW plant, acquired from Monsson, will be situated in western Romania

- Plant expected to be online by 2025, providing clean power to more than 370,000 households

- Potential to integrate symbiotic agricultural activities, including sheep grazing and beekeeping

Rezolv Energy, an independent clean energy power producer focused on sustainable power in Central and South Eastern Europe, has acquired from the Monsson Group the rights to build and operate a 1,044 MW solar photovoltaic plant in Arad County in western Romania. Once constructed, it is expected to be the largest solar PV plant in Europe.

The project is already in the late-stage development phase. Rezolv Energy is already appraising technology solutions and debt financing options with construction due to start in the first half of next year; it is expected to be online by 2025.

The plant will be covered by approximately 1.6 million new solar panels. With an average annual power generation of approximately 1,500,000 MWh, it is expected to be able to provide clean power for more than 370,000 households. The power will be sold to commercial and industrial users through long-term Power Purchase Agreements.

The project will be connected to the 400 kV high voltage overhead lines in the area and will likely include a 135 MW battery storage system, capable of delivering electricity for four hours. This will enable the high voltage lines to be smartly loaded, balancing the variability of the renewable energy supply.

The project will provide a large number of new jobs. During construction, at least 500 Full Time Equivalent (FTE) employees will be hired for a two-year period, both for light assembly – which is work suitable for men and women, on both a full-time and part-time basis – and highly-skilled engineering roles. At least 30 FTE employees will then stay on for the lifetime of the project. There will also be a focus on delivering training and skills development programmes for local communities in and around the project.

The project will be designed, constructed, and operated to the highest environmental, social and governance (ESG) standards, with a particular emphasis on integrating symbiotic agricultural activities on the site. Much of the poor-quality agricultural land will be returned to pasture, with sheep managing the vegetation through grazing. Recent research from the United States has shown the numerous advantages of this approach, confirming that the overall return from grazing is the same in both solar pastures and open fields with no PV panels. The project will also seek to incorporate beekeeping and other measures to increase biodiversity.

Rezolv Energy was launched earlier this year by Actis, a leading global investor in sustainable infrastructure, and the Rezolv leadership team, which had previously developed and run a portfolio of energy projects in Central and South Eastern Europe. Last month, the company announced that it was partnering with Low Carbon to deliver another major renewable energy project in Romania: the 450MW ‘Vis Viva’ onshore wind farm.

“We are moving into a new era for renewable energy in Europe. Projects like this will give us the scale to provide highly competitive, subsidy-free clean power at a stable price for industrial and commercial users. It will also make a significant contribution to Europe’s twin objectives of increasing its energy independence and reducing its net emissions to zero.”

– Jim Campion, Chief Executive, Rezolv Energy

“This transaction illustrates the scale of Actis’ ambition to invest in the Energy Transition across the world in general and in the CEE region in particular. At a time when energy security needs are driving faster adoption of renewable energy, we are excited to be funding Rezolv’s investment in Europe’s largest ever solar photovoltaic plant, expected to provide clean power to more than 370,000 households and constructed and operated to the highest sustainability standards. This transaction follows Rezolv’s announcement in September to deliver a 450MW wind farm in Romania, and we are working closely with Rezolv on further renewable energy investments which we hope to announce in early 2023.”

– Jaroslava Korpanec, Partner and Head of Central & Eastern Europe at Actis

Clifford Chance acted as legal advisor to Rezolv Energy on this transaction.